Life at Admiral

Admiral was founded back in 1993 as a Welsh motor insurance start-up with just 57 people.

Today we’ve got over 11,000 colleagues and we’re the only Welsh company in the FTSE 100 - a fact we’re extremely proud of!

We’ve been at the forefront of change for over 30 years - but there’s one thing that hasn’t changed - our people are just as important to us now as they were back then.

Some colleagues have been with us since the beginning, but however long you’re with us at Admiral you’re accepted, supported and empowered to be you. Because you’re brilliant.

Our Culture

We prioritise doing what’s right: for customers, for each other, and beyond. So you can live by your values and define your own direction.

Ours is an open, honest, and low-ego culture that enables you to flourish. It’s why we’ve been recognised as a Great Place to Work for 25 years, and it’s why our people stay.

Our culture is built on four pillars: Communication, Equality, Reward & Recognition and Fun.

Grow and Progress

At Admiral, the floor is yours. Learn more, make new connections, or just feel the buzz of doing what you love.

We develop and invest in your personal journey to help you reach your full potential, with a strong culture of learning and development. We offer comprehensive online learning, tailored training and the accredited qualifications you need do your best work.

We’re proud of our strong record of talent mobility, so whatever your aspirations are, with Admiral you can achieve them.

Be You

Admiral is a place where you can Be You. Where every colleague feels respected, valued, and empowered to be their true selves.

Our commitment to being a diverse and inclusive place to work runs through everything we do. You’re brilliant, just as you are - and we’ll work hard to make sure your progress is never slowed by barriers related to race, gender, age, sexuality or any of the protected characteristics.

Our Diversity and Inclusion Working Groups run a calendar of events and actively encourage allies to get involved.

We have shaped a culture that gives you the confidence, and a safe space, to represent yourself and what you stand for in our business.

Our six Diversity, Equity & Inclusion Working Groups:

Gender Diversity

Ethnicity & Culture

Ty Rainbow (LGBTQ+)

Multigenerational

Accessibility & Neurodiversity

Social Mobility

Our Benefits

We know our colleagues work hard to serve our customers and keep us innovating, so it’s important to us that they’re well-rewarded.

Alongside our competitive pay we also offer a share package, career growth and development opportunities and a whole host of other great benefits!

Explore our benefits below to discover Where You Can

Where You Can Be You

Financial & Mortgage

Advice

24-Hour

Ecare

Cycle to Work

Scheme

Annual Holiday

Allowance

Flexible

Working

Simply

Health

Private Health

Cover

Critical Illness

Cover

Where You Can Grow & Progress

Learning and

Development

Educational

Sponsorship

Accredited

Qualifications ILM

iLearn

Online Learning

Buy a Book

Scheme

Developmental

Coaching

Port of

Calls

Internal

Mobility

Where You Can Make a Difference

Groups and

Societies

Socials and Team

Days Out

Multi Faith / Quiet

Rooms

Admiral Community

Fund

Give as You

Earn

Awards and Star

Lunches

Corporate Social

Responsibility

Impact

Hours

Where You Can Share In Our Future

Share

Schemes

Refer a Friend

Bonus

Colleague and Family

Insurance Discount

Group Life

Assurance

Pension

Scheme

Life Event

Loan

Tickets to Sponsored

Events

Tusker Salary

Sacrifice

Our Offices

It’s really important to us that our colleagues have a healthy work-life balance and are supported to do their best work, their way.

We have adopted a hybrid approach to work. It’s all about trusting our people to make the right choice in where, when and how they work. Our hybrid model gives our people flexibility and control over how they work. Where possible, this includes working different hours.

Our offices are the beating heart of Admiral. To keep our unique culture and the sense of connection and belonging, we encourage colleagues to come together to collaborate, strengthen relationships and enjoy working together. All of our spaces are designed to make collaboration easy - offering quieter areas for focused working and dedicated areas for company-wide events.

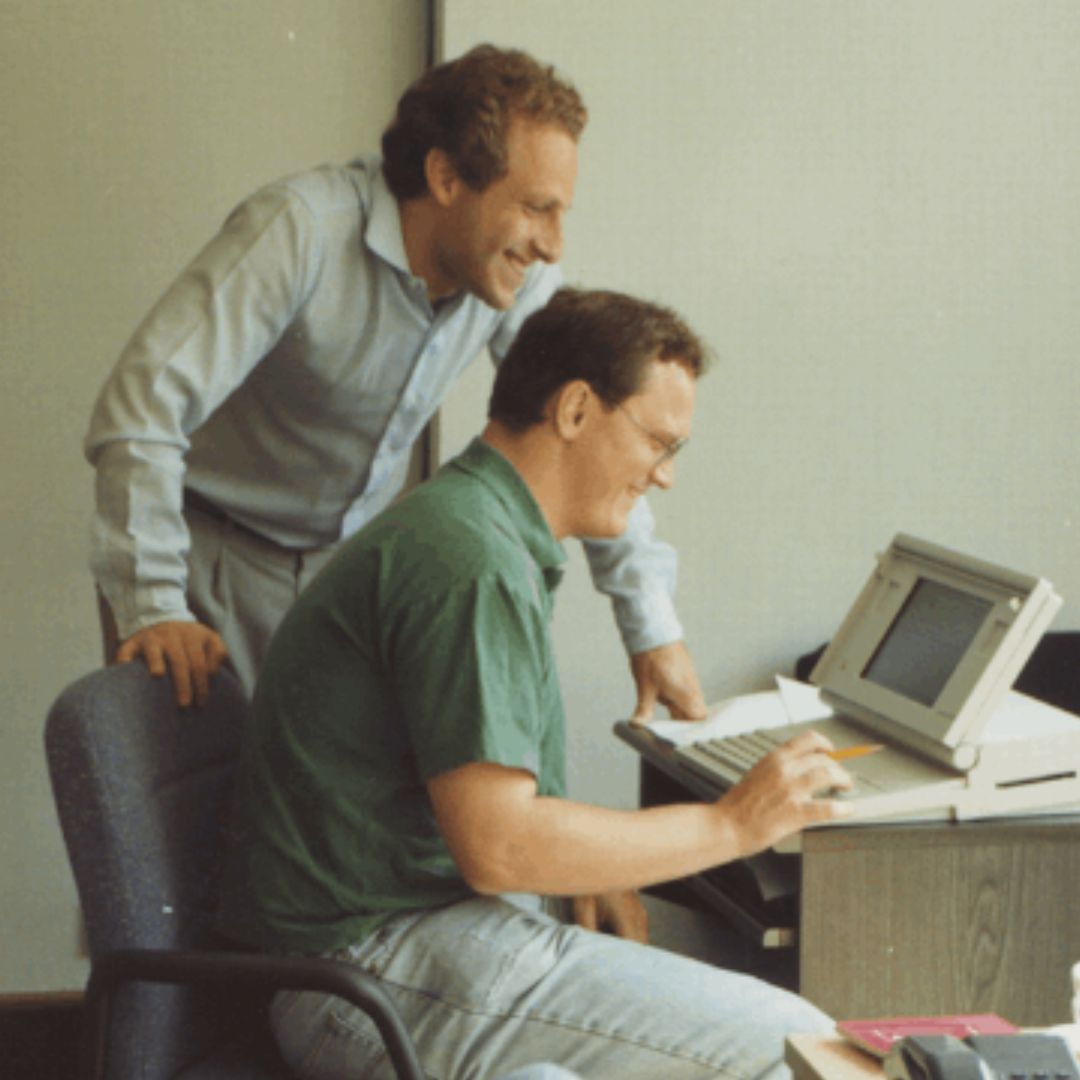

Our Story

From a Welsh motor insurance start-up in 1993, to a multi-billion pound business serving customers in five countries. For the last 30 years our core values of prioritising customers and people haven’t changed.

We are proud to be driven by continuous innovation and the latest technologies, and to be Wales’ only FTSE 100 company.

Take a scroll through our history and check out our open roles to see where you could fit into our future.

January

On 2nd January 1993, Admiral launched with 57 colleagues and the first insurance policy was sold at 9:10AM.

1993

August

The first Admiral TV advertisement was broadcast.

1993

October

Admiral's website launched, making it the first direct insurer with an internet presence in the UK.

1995

June

Diamond and Bell launched. Diamond was launched for female drivers with lower claims, and Bell for customers without a no claims bonus.

1997

April

Gladiator launched as a commercial vehicle insurance intermediary.

1998

November

Henry Engelhardt led a Barclays-backed management buyout of Admiral Group from Brockbank Group.

1999

August

Elephant launched and the Admiral Group became the first UK insurer to offer customers motor insurance through an online journey.

2000

March

Admiral Group makes the inaugural The Sunday Times 100 Best Companies to Work For list and has done so every year since!

2001

March

Confused.com, the UK's first insurance aggregator, was launched by the Group.

2002

September

Admiral Group went public at £2.75 per share and a £711 million market cap, becoming Wales' highest valued public company.

2004

December

Admiral Group welcomes its 1 millionth customers.

2004

December

Admiral becomes the first company in the UK to launch MultiCar, allowing UK customers to insure two or more cars on the same policy.

2005

October

Balumba, the Group's first motor insurance business in mainland Europe is launched in Spain.

2006

December

Admiral Group enters the FTSE 100

2007

May

ConTe.it, the Group's second direct insurance business in mainland Europe is launched in Italy.

2008

October

Elephant Auto, the Group's first insurance business in the United States, is launched.

2009

December

L'olivier - assurance, our direct insurance operation in France, was launched in Paris.

2010

July

A second Spanish direct insurance brand, Qualitas Auto, is launched to provide motor insurance for those who traditionally struggle to access cover.

2012

December

Admiral UK launched its first household insurance products.

2012

March

Price comparison site Compare.com is launched in the USA.

2013

May

Admiral Group's law firm, Admiral Law was launched in the UK.

2013

February

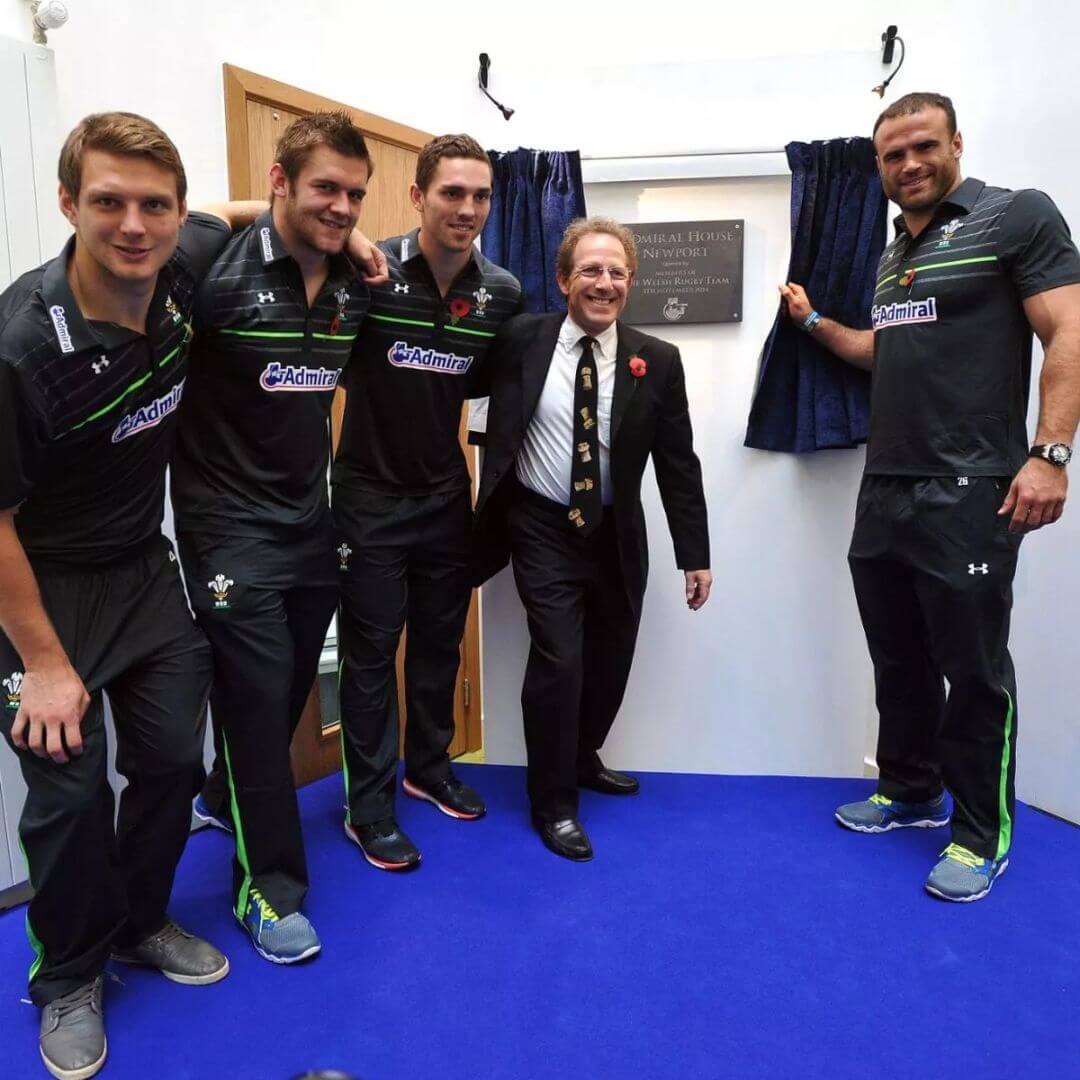

Admiral Group's new headquarters, Tŷ Admiral, was officially opened by members of the Welsh rugby team.

2015

June

Admiral Group launched its unsecured personal loans business, Admiral Money.

2015

November

Launched Travel offering three levels of policy; Admiral, Admiral Gold and Admiral Platinum.

2017

February

Admiral UK received a lifetime award for being the only company to appear on the Best Big Company to Work For list for 20 consecutive years.

2020

March

In response to the pandemic, the Group launched a Covid-19 support fund, donating £6 million over two years to local communities.

2020

May

Due to Covid-19 lockdowns, Admiral UK issued a Stay-at-Home Refund, returning £110 million to motor insurance customers.

2020

October

ConTe, our Italian business, launched pet insurance.

2020

April

Admiral Group sells its comparison businesses in the UK and Europe to RVU

2021

May

Admiral Pioneer is launched! A venture building business which focuses on long-term diversification.

2021

July

Our Italian operation ConTe, launches its loans business, better known as Con Te Prestiti

2022

August

Admiral UK launches its own Pet insurance.

2022

January

Admiral turns 30! On 2nd January 2023 we celebrated 30 years since Admiral Group was launched in Cardiff.

2023

December

Admiral signs agreement to acquire the UK direct Home and Pet personal lines insurance operations of RSA Insurance Group Limited.

2024

We have over 11,000 colleagues who all strive to serve our 10 million customers in line with our purpose to:

Help more people to look after their future.

Always striving for better, together.

Our Stories

.png)

Teaser

Admiral MoneyContent Type

BlogPublish date

20 Nov 2025

Summary

Being able to come to work and just be myself is something I used to take for grantedWhen I joined Admiral in 2007, I was a young 24 year-old who didn’t plan as far out into the weekend, let alone

by

Abi Taylor

Teaser

Business SupportContent Type

BlogPublish date

10 Nov 2025

Summary

Here at Admiral, learning is part of who we are. We’re proud of our record of promoting from within and giving colleagues the chance to explore new opportunities and build varied, rewarding career

by

Aimee Richards

+(16).png)

Teaser

TechnologyContent Type

BlogPublish date

27 Oct 2025

Summary

At Admiral, we’ve always embraced technology as a way to do things differently. That pioneering spirit continues today. We believe that Tech and Data aren’t the domain of just one type of person

by

Katie Gratland

+(14).png)

Teaser

TechnologyContent Type

BlogPublish date

22 Oct 2025

Summary

We recently caught up with Chris Locke, Cyber Security Product Manager, who’s been part of Admiral since 2011. We wanted to hear about his journey and what’s kept him here for over 14 years. Ba

by

Katie Gratland

Guidance for using AI during the hiring process

We welcome you to use AI tools to support your application if you choose. Your use of AI won’t affect how you are assessed. However, if you do decide to use it, we encourage you to use it thoughtfully and effectively.

Find out More